News Centerbarrow

Industry News

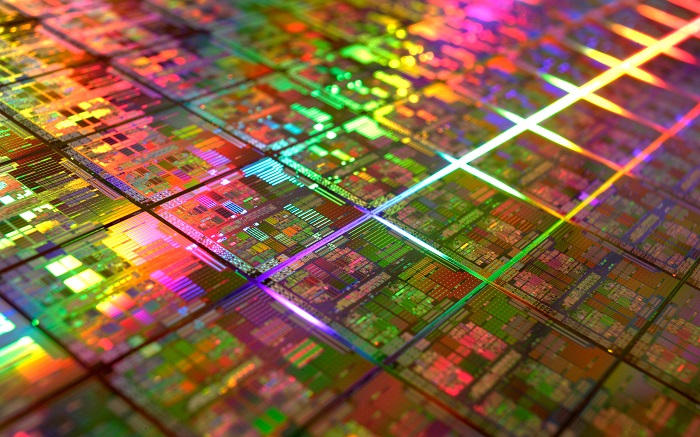

South Asia is developing the 10nm DRAM technology

2019-05-27 23:15 The author:Administrator

Although the memory price haven't back to early 2017 levels, but compared with 900 yuan before a 8 gb "robbery" type of DDR4 prices have improved, DRAM prices, in addition to the three major manufacturers production capacity is insufficient, and data center, there is a close relationship between the server market, because the server and data center for DRAM market is very strong, if the market supply and demand tends to saturation state, then it can help memory DIY market prices. According to the south Asian technology company CEO Li Peiying, they have begun to 10 nm technology products research and development, mainly for the server and data center market, manufacturers, led by samsung, have the new players to join.

In the fourth quarter of last year in South Asia has large-scale production of 20 nm 8 gb DDR4 chip, Li Peiying when is their DDR4 chip is aimed at the server market, because the server is the demand of the market is far higher than that of the smartphone market. Looking ahead, South Asia will open up more advanced LPDDR4 production lines. Li Peiying is pointed out that South Asia development of 10 nm process technology can let the data center market in South Asia, he also predicted DRAM market supply and demand in 2018 will be in equilibrium state, and some firms in the second half of this year will expand capacity.

South Asia capital spending is approximately nt $11.5 billion in 2018, the expenditure is mainly used in advanced technology and new product research and development, the company is still focused on DRAM market, and will continue to make the product diversification, data center is the next target market.

South Asia is 20, 2017 nm technology transition, they have 20 nm chip manufacturing costs less than 30 nm, favorable market conditions in South Asia in 2017 reached a record net profit of nt $40.29 billion, the year EPS was 14.36 t.